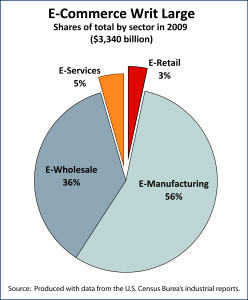

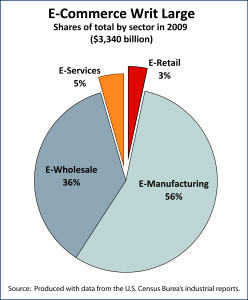

The announcement this week that two large players in the Internet world have made billion dollar plus acquisitions made us think again about e-commerce. It is a term that is used regularly but one suspects that its meaning is somewhat subjective and based on the user’s own concept of the business. E-commerce can be viewed, as it often is, as electronic shopping. Of course, that might more accurately be called e-shopping or e-retail. Commercial exchange is much bigger than that.

By taking the electronically transacted portions of each of the primarily commercial sectors of the economy, we see (in the pie chart) that e-retail makes up only a small share of the more broadly defined e-commerce. E-wholesale and e-manufacturing account for the lion’s share of the total but they are not new and shiny and so attract far less media attention or investor interest.

Even within the retail sector as a whole, e-commerce accounts for just under 5 percent of the whole. That percentage is, of course, growing, and growing rapidly. It is this fact that must be causing companies like Facebook to spend in excess of $1 billion on a company with a popular photo sharing app (Instagram). Worth noting is the fact that in some retail sectors, e-commerce does play a far larger role than the 5 percent it represents of the sector at large: electronics and books are two such.

Today’s market size numbers measure the size of the U.S. retail sector in the 4th quarter of 2011, and the size of the e-commerce portion of that total.

Geographic reference: United States

Year: 2011, 4th quarter

Market size: Retail, $1.072 trillion, E-commerce: $51.38 billion (4.8% of total retail)

Source: Quarterly Retail E-Commerce Sales, 4th Quareter 2011, U.S. Census Bureau, available online here.

Original source: U.S. Department of Commerce, Bureau of the Census

Posted on April 11, 2012