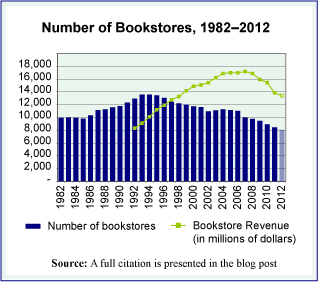

A recent article titled “Independent bookstores turn a new page on brick-and-mortor retailing,” by Michael Rosenwald and published on the Washington Post.com web site, here, grabbed our attention. It appears that after years of shrinking, idependent bookstores may have hit bottom. In fact, there are some signs of growth as new independent store openings may be outpacing closures.

As we learned some years ago when we did a study of the publishing industry, getting reliable statistics on the national book retailing industry is not easy. This is in part because it is always difficult to track an industry that is going through significant change and reorganization. The selling of books definitely falls into that category. Over the last two decades it has been a standout in this regard within an entire sector—the retail sector—going through significant change. From the rise and fall of the big bookstore chains such as Borders and Barnes and Noble to e-books, Amazon and the spread of books into a growing number of big box, discount outlets, independent booksellers have seen their share of the business shrink for decades.

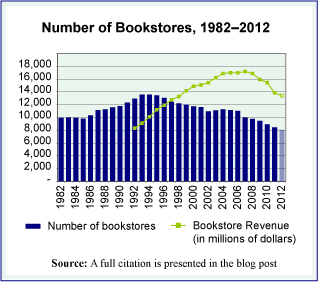

The graph we offer shows the total number of bookstores in the United States, annually, over a three decade period. It also shows industry revenues for the last twenty years of that period. The data charted all come from the U.S. Census Bureau’s reports on the industry and their County Business Patterns database. While total bookstore numbers are available, it is more difficult to tease out of these data the store count by independent bookstores versus the larger stores run by big chains that began to dominate the industry in the 1990s. The graphic fails entirely to capture the rise of e-books and e-commerce. Nonetheless, it provides an overview of the pattern made by the ups and downs of the bricks-and-mortar bookstore.

From these overall figures we can make educated estimates a few things. By taking data from the Annual Reports of three of the largest bookselling chains, Borders (until 2011), Barnes and Noble, and Books-A-Million, we have calculated the following rough outline of Independents versus chains in 2002 and a decade later, in 2012. In 2002, the three largest chains accounted for 21% of all bookstores and 49% of bookstore sales. In 2012, after the bankruptcy of Borders, the remaining two large chains accounted for approximately 20% of the stores and 57% of all the sales made by bookstores.

Today’s market size is the approximate number of independent bookstores and small chain bookstores in the United States in 2012 as well as the value of their sales in that year.

Geographic reference: United States

Year: 2012

Market size: 6,043 bookstores with revenues of approximately $5.76 billion (based on Census data on bookstore sales, less sales by the two largest chains, Barnes & Nobel and Books-A-Million)

Sources: (1) Gabe Habash, “Bookstores in America, 2013: A State-by-State Guide, Publishers Weekly, June 1, 2013, available online here. (2) Latest Annual Retail Trade Reports, part of the Census Bureau’s monthly and annual compilation of data on the retail sector, taken from the web site here and more specifically, the report titled Annual Retail Trade Survey—2011: Sales (1992-2011) using monthly reports to update the annual figure for 2012.

Original Source: U.S. Department of Commerce, Bureau of the Census, the American Booksellers Association, and Publishers Weekly

Posted on December 30, 2013